Daily Brief - Wednesday, 5/28/25

Strong close, rising value, and new business point to bullish intent — but all eyes now on a breakout above 21,558.50 to confirm the next leg higher.

Disclaimer

This publication and its authors are not licensed investment professionals. Nothing posted on The Shmuts blog should be construed as investment advice. Do your own research.

Catch me on Twitter @TheShmuts during the day covering the session as it develops.

News Docket

Wednesday - 5/28/25

2:00pm EST - FOMC Meeting Minutes

Thursday - 5/29/25

8:30am EST - US Initial Jobless Claims (Expected: 230k)

8:30am EST - US GDP QoQ 2nd Estimate (Expected: -0.3%)

Friday - 5/30/25

8:30am EST - US PCE Price Index YoY (Expected: 2.2%)

8:30am EST - US PCE Price Index MoM (Expected: 0.1%)

8:30am EST - US Core PCE Price Index YoY (Expected: 2.5%)

8:30am EST - US Core PCE Price Index MoM (Expected: 0.11%)

8:30am EST - US Consumer Spending MoM (Expected: 0.2%)

10:00am EST - Univ Michigan Sentiment Final (Expected: 51)

Prior Session Analysis - Tuesday, 5/27/25

Session Stats

Open: 21,259.50

High: 21,488.50

Low: 21,192.75

Close: 21,466.50

Settlement: 21,460.50

Range: 295.75 pts (1183 ticks)

Volume (Est.): 532,526

Open Interest (Prelim, NQM5): +7,139

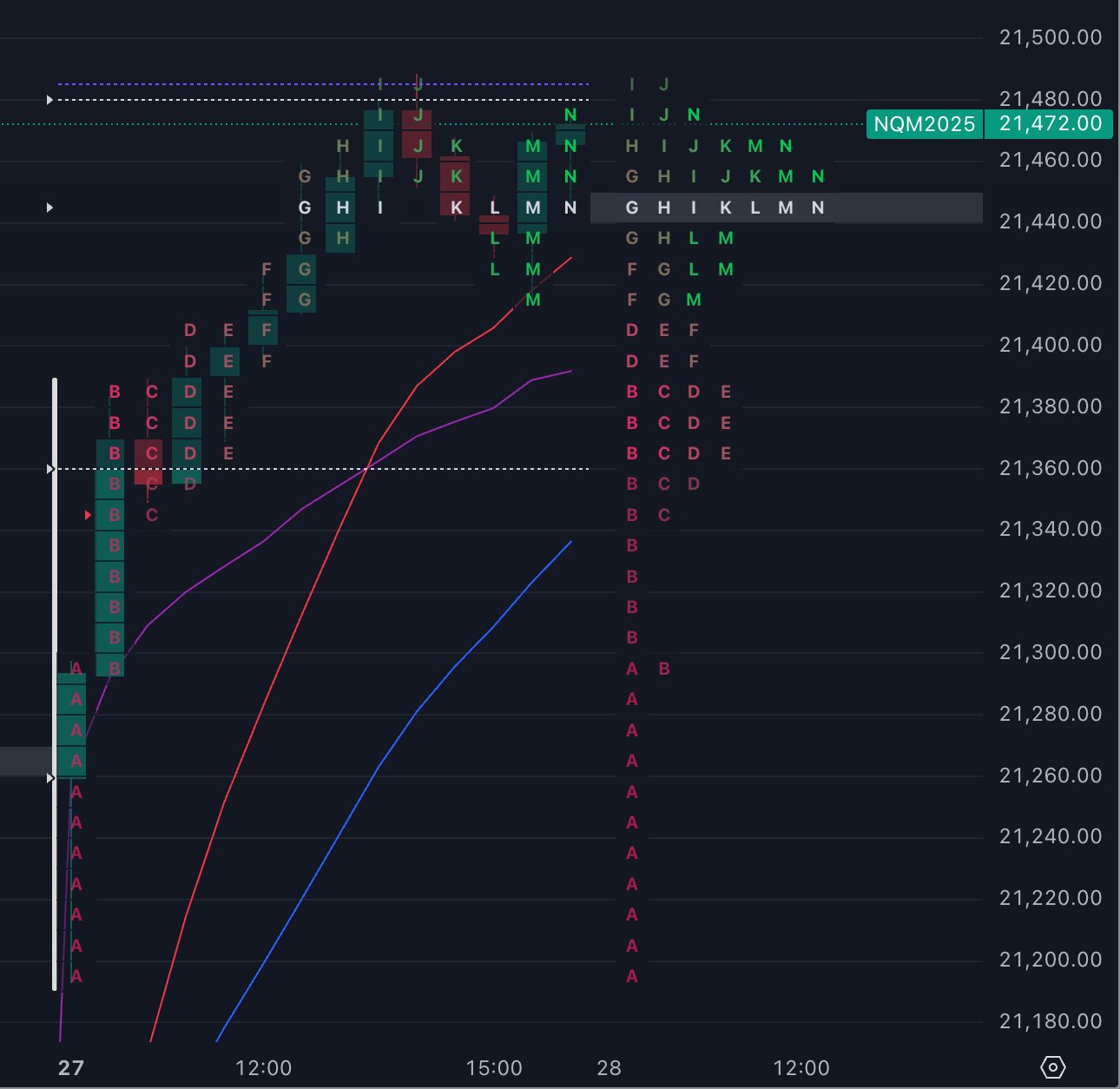

Value Area (Market Profile)

Value Area High (VAH): 21,480.00

Point of Control (POC): 21,444.75

Value Area Low (VAL): 21,360.00

Prior Session Breakdown - Market Profile and NY Session

Market Profile View – 30-Min Chart

Tuesday was a Normal Variation day with upside range extension that held into the close, showing continued buyer strength. The session opened with a substantial gap higher off the back of Trump’s EU tariff delay and, after a quick dip to ~21,200 off the open, buyers stepped in with conviction and remained in control through most of the session.

Through 1:30pm ET, price action resembled a Trend Day, with clear one-timeframing upward. From 1:30pm into the close, trade became more two-sided, but buyers still maintained strength, holding price near the top of the day’s range into settlement.

NQ now sits within striking distance of breaking out to a new higher high on the daily chart. A close above 21,558.50 would confirm that breakout.

Market Structure Highlights:

Strong single-print buying tail from 21,340 down to 21,200, showing aggressive buyer rejection of lower prices early in the day.

POC and Value Area rotated higher, now above all sessions since May 19.

Wider Value Area (~50% of total range) reflects improved trade facilitation and more balanced price discovery.

Yesterday’s Market Profile has the hallmarks of a potential short squeeze.

5-Minute Chart Breakdown – NY Session

The early dip to 21,200 was shallow and quickly rejected, setting the tone for the rest of the day. Buyers marched price steadily higher in the morning, establishing a clean trend. The afternoon saw more rotation but lacked strong selling pressure, reinforcing the bullish structure.

No late-day spike occurred, but buyers held the upper end of the range into the close, keeping the possibility of continuation alive going into today’s session.

Volume & Participation

Open Interest: +7,139 — Substantial addition in new business. If paired with short covering, this OI jump strengthens the bullish case.

Volume: ~532k — In line with recent session averages.

Range: 295 pts — Modest, but sufficient for clean intraday setups.

Final Thoughts

Tuesday confirmed bullish intent with sustained control by buyers, clean market structure, and a strong close. The large OI increase is worth watching — if it reflects new longs rather than just covering shorts, it’s a strong vote of confidence. With price nearing key breakout territory on the higher timeframe, today’s session could be pivotal.

Today’s Analysis – Wednesday, 5/28/25

Market Context

At the time of writing, overnight inventory is slightly long — ~40 points above yesterday’s settlement, with price currently trading just within yesterday’s high. That puts us near the upper end of the range but still within it, which could result in an in-balance open unless we see a stronger move before the bell.

Tuesday’s session showed strong buyer interest throughout the day, even as the auction turned more two-sided into the afternoon. Still, the day closed near its highs, and price is now within striking distance of a new higher high on the daily chart (21,558.50).

We also saw a significant increase in open interest (+7,139), suggesting this move had real participation. That’s worth noting — this wasn’t just short covering, there were likely new longs entering the market. Combine that with a clean auction, rising value, and strong close, and the message from the market is clear: the bulls are still here.

The only caveat? It’s still news-driven tape, and while structure supports continuation higher, we know how quickly sentiment can turn. Stay nimble.

Bias & Mindset

Bias: Neutral → Bullish

With yesterday’s strength and a modest overnight move higher, my lean is cautiously bullish — but I’ll be patient off the open. If we stay in-balance, I’ll let the opening range develop and look for signs of initiative activity.

The big question today: can buyers push us above 21,558.50 and hold above it? If they do, we’re breaking into fresh upside territory on the higher timeframe.

That said, if we see signs of exhaustion or rejection at those highs, I’ll look to fade the move back toward value. As always, I’ll let order flow and tempo guide my decisions.

Key Levels I’m Watching Today

Upside:

21,558.50 — Key higher timeframe level; a close above confirms a breakout

21,530.00 — Last week’s high; already tested multiple times

21,480.00 — VAH from Tuesday

21,444.75 — Tuesday’s POC

Downside:

21,360.00 — Tuesday’s VAL

21,340 → 21,200 — Single-print buying tail from Tuesday; strong buyer defense here

21,083.00 — Friday’s high and the gap fill level from this week’s rally

21,000.00 — Psychological level; watch for sentiment shift below

Final Note on Today

The rally showed new life Tuesday, but today’s job is about confirmation. Do buyers have the strength to break out of this multi-session range and hold it? If so, the next leg higher could be underway.

But with price already elevated and news risk always present, this is a day to stay tactical. Let price lead. If we move cleanly above resistance and hold, I’ll look to buy pullbacks. If we see signs of rejection, I’ll wait for confirmation before fading.

Patience over prediction.

Enjoying The Shmuts? Help Me Spread the Word

If you’ve been finding value in the Daily Brief or other posts, I’d be incredibly grateful if you shared The Shmuts with other traders—whether that’s in a Discord group, on social media, or just with a trading buddy. It only takes a few seconds, but it helps more than you know.

Thanks so much for your support!