Daily Brief - Tuesday, 6/10/25

Market Coils in Silence as China Trade Talks Drag On — Low Tempo Persists, But Breakout Potential Builds

Disclaimer

This publication and its authors are not licensed investment professionals. Nothing posted on The Shmuts blog should be construed as investment advice. Do your own research.

Catch me on Twitter @TheShmuts during the day covering the session as it develops.

News Docket

Wednesday - 6/11/25

8:30am EST - US CPI YoY (Expected: 2.5%)

8:30am EST - US CPI MoM (Expected: 0.2%)

8:30am EST - US Core CPI YoY (Expected: 2.9%)

8:30am EST - US Core CPI MoM (Expected: 0.3%)

Thursday - 6/12/25

8:30am EST - US Initial Jobless Claims (Expected: 240.5)

8:30am EST - US PPI YoY (Expected: 2.6%)

8:30am EST - US PPI MoM (Expected: 0.2%)

8:30am EST - US Core PPI YoY (Expected: 3.1%)

8:30am EST - US Core PPI MoM (Expected: 0.3%)

Friday - 6/13/25

10:00am EST - Univ Michigan Sentiment Prelim (Expected: 53.5)

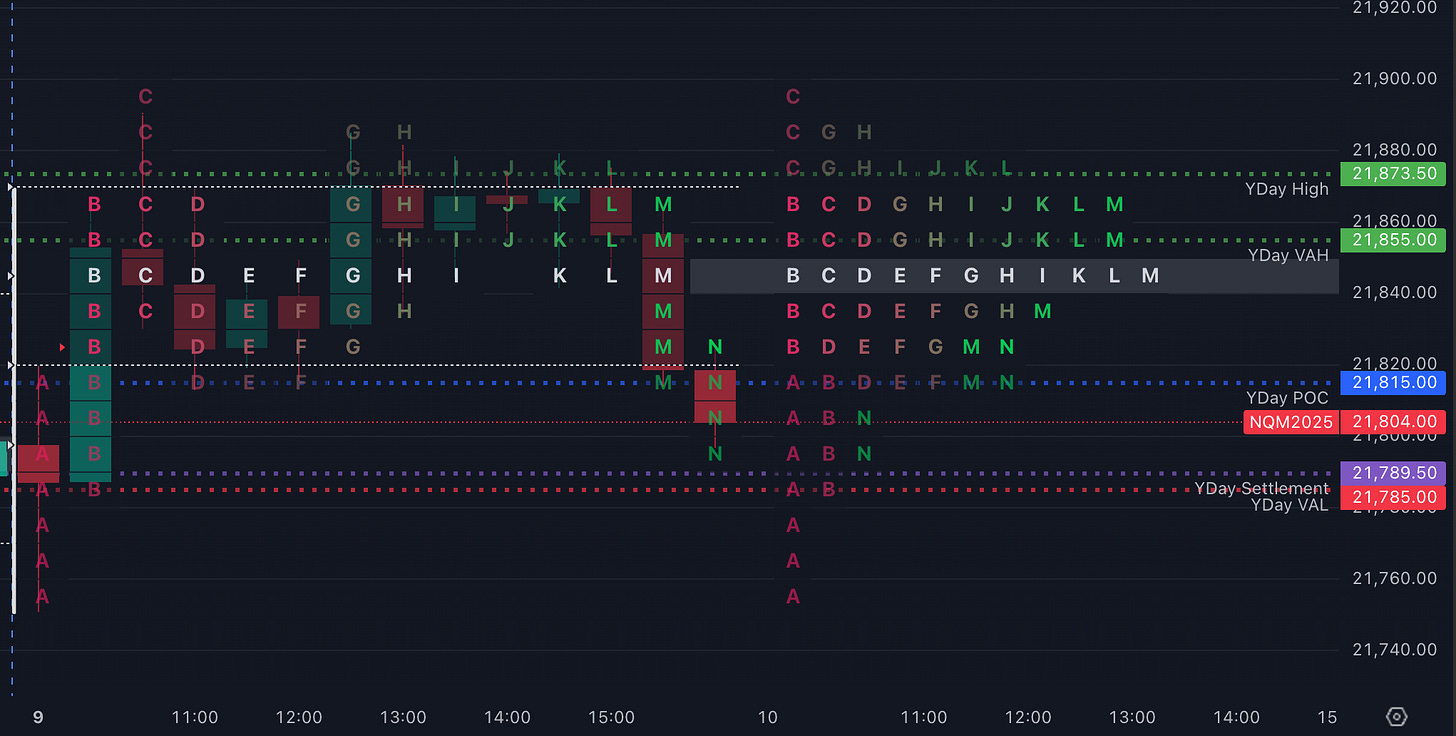

Prior Session Analysis - Monday, 6/9/25

Session Stats

Open: 21,797.50

High: 21,890.75

Low: 21,750.75

Close: 21,838.25

Settlement: 21,821.50

Range: 140.00 pts (560 ticks)

Volume (Est.): 357,820 — Lowest session volume since April 28th

Open Interest (Prelim, NQM5): -31 — Flat, with no clear directional initiative

Value Area (Market Profile)

Value Area High (VAH): 21,890.50

Point of Control (POC): 21,854.50

Value Area Low (VAL): 21,806.50

Prior Session Breakdown - Market Profile and NY Session

Monday’s session was a textbook low-energy, low-conviction grind, producing a tight, balanced profile with rejection on both extremes. Despite a slight bullish bias in structure — as reflected in the upward rotation of VA and POC from Friday — there was no meaningful directional move.

Price respected the initial balance boundaries throughout the day, with each venture beyond it quickly rejected. While buyers were able to defend the lower end of Friday’s value, they couldn’t generate momentum above the 21,890 level, which aligns closely with a composite swing high from early May.

Structurally, the profile resembled a developing coil, indicative of a market that's primed to move but waiting on a catalyst. This coiling behavior has been in place since early June, and Monday further reinforced it.

From the tape:

Order flow showed steady participation at the extremes but no follow-through, suggesting active responsive participants — not initiative buyers or sellers.

Volume tapering during breaks above IB high points to a lack of institutional conviction.

From the contextual backdrop, there were two key macro events traders were cautiously watching:

US–China trade talks, reportedly continuing quietly in London. The lack of updates likely kept traders sidelined.

Apple’s WWDC kickoff, with low expectations around AI developments. No news from the keynote added to the session’s flat tone.

Additional Observations:

Value and POC rotated higher from Friday, which is quietly bullish.

Price action showed clear signs of responsive activity: no conviction to break higher or lower.

Market is likely waiting for resolution on trade talks or this week’s CPI data before expanding range again.

The 21,935 area remains a key upside breakout level. Below, 21,750 is still acting as a responsive buy zone.

Volume & Participation

Volume: 357,820 — Notably the lightest session since April 28th. Confirmed lack of institutional interest or urgency.

Open Interest: -31 — Small dip implies net even positioning. Possibly light profit taking or hedging.

Range: 140 pts — Narrow, consistent with compression phase conditions.

Final Thoughts

This was the quietest day we’ve seen in weeks, both in terms of tempo and volume. Still, structure suggests a market that is coiling and waiting. If the trade headlines shift or CPI surprises later this week, we could quickly transition from compression to expansion.

This is the calm before the potential storm. Stay alert.

Today’s Analysis – Monday, 6/9/25

Market Context

At the time of this writing, overnight inventory is balanced to slightly long, trading about 25 points above yesterday’s settlement of 21,821.50. Price has remained within yesterday’s range, which suggests we’re likely to open in-balance — a signal that the market is still digesting prior value and hasn’t found a compelling reason to reprice.

Yesterday’s session was a quiet one: low tempo, low volume, and no conviction beyond the IB. It was the lowest volume day since April, and the market treated every move outside the initial balance with rejection. That’s often a sign of waiting — and right now, the market is clearly waiting on headlines. Specifically, traders are watching for any significant developments out of the ongoing US–China trade talks in London. The lack of updates so far has only deepened the market’s sense of indecision.

Structurally, yesterday’s POC and value area shifted slightly higher, hinting that buyers are still in control — but barely. The tight daily range and rejection at the highs showed that while there may be underlying bullish intent, nobody is willing to push the throttle until the fog of uncertainty lifts.

As we open today, be aware that headline risk is still the primary driver. We’ve seen this setup before: a seemingly balanced session that suddenly ignites on a tweet or sound bite. So far, though, the tone remains muted, and we could be in for another session of slow chop and mean reversion unless news hits.

Bias & Mindset

Bias: Neutral

I’m heading into today with a neutral stance. Price is coiling and the market remains unresolved. With overnight inventory flat and price stuck in yesterday’s value, I’ll treat this as a balanced market and plan accordingly.

That said, I’m on high alert for news from the China trade talks, which could quickly break us out of this balance and kick off directional movement. Until that happens, I expect more of what we’ve seen: slow tempo, modest ranges, and false starts outside the IB.

My job today is to stay patient, let the market open up, and watch for genuine momentum before stepping in. In a tape like this, forcing trades out of boredom is a quick way to rack up losses.

Key Levels I’m Watching Today

Upside:

22,000.00 – Psychological magnet and the line just below all-time highs. A close above here would signal bullish intent is back in force.

21,935.00 – Pivot high from 6/5. This level remains a key hurdle for continuation of the larger timeframe uptrend.

21,873.00 – Yesterday’s main resistance; price was rejected here 5 times. A clean break and hold above would be a shift in behavior.

21,855.00 – Value Area High (VAH) from Monday. A push above this would show buyers reclaiming control and developing value higher.

Downside:

21,785.00 – Value Area Low (VAL) from Monday. A fade back into yesterday’s value area would suggest further balance.

21,740.00 – Monday’s low; tested multiple times and defended. A break below would shift short-term control to sellers.

21,558.50 – High from 5/27; a structural breakout level and former resistance turned support. If this fails, the rally could be losing steam.

21,540.00 → 21,500.00 – Congestion zone from early June. Below this, the market may rotate back down to test the breakout structure.

Final Note on Today

We’re back in “wait-and-see” mode. The market has all the characteristics of one that wants to break higher—tight ranges, higher value area rotation, and firm rejections of lows—but it’s hesitating without a clear catalyst. All eyes remain on the US/China trade talks, and without concrete headlines, today could very well mirror yesterday’s slow, balanced price action.

That said, these kinds of sessions can set the stage for explosive moves once new information hits the tape. Stay nimble, stay patient, and remember: if price is stuck inside yesterday’s value and tempo is weak, there’s no harm in keeping your powder dry. Let the market tip its hand—don’t force it.

Enjoying The Shmuts? Help Me Spread the Word

If you’ve been finding value in the Daily Brief or other posts, I’d be incredibly grateful if you shared The Shmuts with other traders—whether that’s in a Discord group, on social media, or just with a trading buddy. It only takes a few seconds, but it helps more than you know.

Thanks so much for your support!