Daily Brief - Tuesday, 3/18/25

The rally continued yesterday. The Ukraine war peace talks are front and center for the market. The news will drive sentiment today.

Disclaimer

This publication and its authors are not licensed investment professionals. Nothing posted on The Shmuts blog should be construed as investment advice. Do your own research.

A Warning for this Week

A few key factors to watch for in the upcoming week—four major variables are aligning, which could drive significant volatility and dramatic price movements in NQ.

March 2025 (NQH25) Contract Expiration – Friday, March 21st

There are still 243K contracts that need to be rolled, closed, or allowed to expire by the deadline.

Rollover week historically leads to erratic price action, so much so that many futures traders avoid trading altogether due to the added risk.

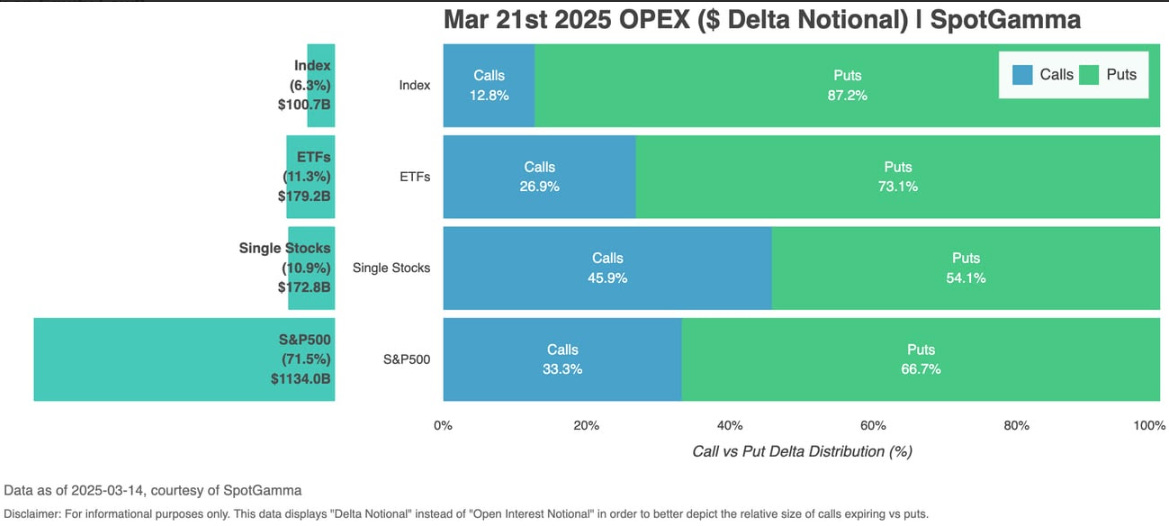

March OPEX (Options Expiration) – Friday, March 21st

This week, approximately $756 billion in put options on S&P 500 stocks are set to expire.

The key takeaway is what happens behind the scenes:

Market makers (MMs) are typically the other side of the trade when options contracts are opened.

The majority of outstanding puts were bought to open (long puts) due to the recent downtrend.

Since MMs are short the put, they buy stock to hedge their position.

As these contracts are closed, exercised, or expire, MMs will unwind their hedges, meaning large-scale selling could hit the market, adding to volatility.

FOMC Meeting – Wednesday, March 19th

FOMC meetings always bring volatility, but with the other factors at play this week, we may not get the usual calm before the storm leading up to the announcement. While the market expects no rate cut, all eyes will be on the press conference for clues on future policy shifts—especially any signals on the timing of the next rate cut.

News Shock Risk

Don’t overlook the ongoing risk of unexpected news shocks—a reality traders have been navigating for the past two months. Combine this with the other market-moving events, and we could be in for an extremely volatile trading environment. Stay sharp.

Discretion is the better part of valor. I call weeks like this "survival weeks"—where the primary goal isn’t maximizing profits, but protecting capital and getting through unscathed. If you happen to make money, great—but that’s secondary.

There’s no shame in sitting on the sidelines and avoiding unnecessary risk. If you choose to trade, size down, manage stops carefully, and stay prepared for sudden price swings in either direction. Scalping is a valid approach—see money, take money.

Upcoming News

Tuesday - 3/18/25

8:30am EST - US Housing Starts (Expected: 1.375M, Actual: 1.501M)

9:15am EST - US Industrial Production MoM (Expected: 0.2%)

Wednesday - 3/19/25

2:00pm EST - Fed Median Rate Forecast (Expected: 4.375%)

2:00pm EST - US Interest Rate Decision (Expected: 4.5%)

2:00pm EST - FOMC Summary of Economic Projections

2:00pm EST - FOMC Rate Statement

Thursday - 3/20/25

8:30am EST - US Initial Jobless Claims (Expected: 224k)

10:00am EST - US Existing Home Sales (Expected: 3.94M)

Prior Session Stats and Analysis - Monday, 3/17/25

Session Open: 19,908.75

Session High: 20.145.25

Session VAH: 20,024.25

Session POC: 19,919.00

Session VAL: 19,850.00

Session Low: 19,834.75

Session Close: 20,120.50

Session Settlement: 20,038.25

Session Range: 310.5 pts, 1242 ticks

OI Change (Prelim): +11,704 (NQ) / +7,808 (MNQ)

Est Volume: 1,094,020

Prior Session Analysis

Yesterday’s session was a Neutral day with range extension on both sides of the Initial Balance. We had a single-print buying tail at the bottom of the range during the late morning which could act as resistance in coming sessions if price revisits the 19,640 area. Even though we saw significant range extension to the upside, price spent the majority of its time at the bottom of the range yesterday and that was where the fairest price was found.

We saw a significant uptrend develop a little after 1pm with a total range of almost 280 points. This auction up was the best opportunity for momentum traders yesterday. The auction down into close was another. The morning was mostly chop and hopefully you managed to be patient and stay out of that.

From a participation standpoint:

NQ added a net of +11,704 contracts on Friday.

March 2025 (NQH25) contracts decreased by -76,460.

June 2025 (NQM25) contracts increased by +88,141.

Volume was the highest it has been on my chart going back to Feb 3rd, with over 1 million contracts traded.

Plan for Today - Tuesday, 3/18/25

At the time of this writing, overnight inventory is short +90 points below yesterday’s settlement. Housing starts data came in higher than expected and the market’s initial reaction is bearish to the news. This puts us back inside of yesterday’s range but near the top. It’s it not out of the question for price to auction back up and open outside of yesterday’s range.

If you are trading NQ, you should be switching over to the June 2025 contract starting today (NQM25). Prices will be different than NQH25, don’t be caught off guard. There is a time aspect to prices in forward contracts, the farther out you go the higher the price is. Prices I list on here starting today will represent NQM25 prices, not NQH25 prices.

My plan for today given the volatility and variables is to be patient, regardless of where we open and to scalp opportunities as they present themselves. This assumes I have some time to trade today in NQ.

Keep an eye on the Ukraine/Russia news today. Based on what I’m hearing, news about a peace deal is very important to the markets right now. Tariffs are second.

I did not post a trading results update yesterday because I did not trade yesterday. Work demanded my full attention yesterday and I don’t trade anything unfocused. Also, I’ve decided to start another combine. The reasons are:

Given all the factors for volatility this week I didn’t think it was the best environment to start my funded account.

It’s always a good idea when you pass a combine, to start another so you can have one in the hopper just in case you blow your funded account. With the prop firm I’m using you can have up to 5 funded accounts so I plan to build these up so I always have a funded account ready to go just in case I need it. I can also copy trade them.

Levels I’ll be watching for today:

20,145 - area of yesterday’s high in NQM25.

20,065 - area of overnight high in NQM25.

20,000 - key level, an auction up and retake of this level will be bullish. Overnight inventory did auction up and above this level on two separate occasions before ultimately auctioning back down below.

19,931 - area of support multiple times in the overnight session in NQM25.

19,835 - area of yesterday’s low in NQM25, a break below this would be bearish.